6 Year Anniversary of the Bull Run

- Lisa Perry

- Apr 11, 2023

- 2 min read

On the 6th of March it was six years since the Bull Market started. Quite something, when you consider that the JSE All Share Index stood at 18000 compared to today which is 52875.

Total returns from the market since 2009 are:

242% or 22,6% per year compound growth.

In dollar terms this translates to 19,6% per year although the ALSI in dollars has broadly moved sideways for the past 3 to 4 years. Excluding dividends, the ALSI return has been19,2% per year compounded, so dividends have added avery impressive 3,4% per year compounded over the past 6 years.

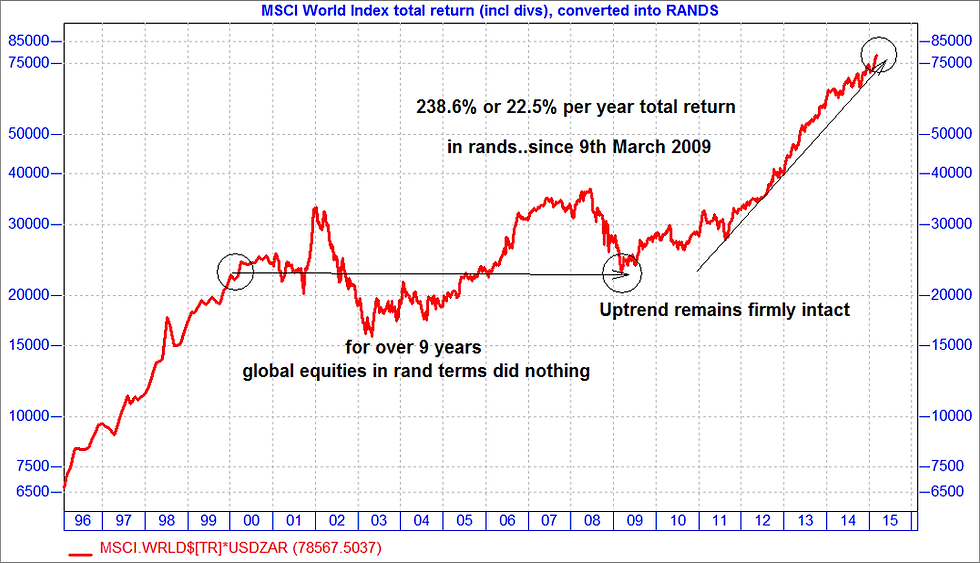

The MSCI World Index has done 193% in dollars over the past 6 years, or 19,6% compounded per year including dividends, so that is almost trebling in dollar value. In Rand terms the MSCI World Index gas done 238,6%or 22,5% per year, almost identical to the return of the All Share Index over the 6 year market bull market period.

Prior to 2009 SA investors made no money in rands in developed markets for over 9 years from January 2000 to March 2009.

Clearly patience is now paying off big time. Those investors who held on to their offshore investments from the year 2000 or thereabouts are now reaping the fruits of their patience.

All in all though stock markets are experiencing a pullback at this time and no one knows how far the pull back will go, corrections or pullbacks are normal in a bull market and at this stage there are no signs that this bull market is over as yet, not by a while.

All in all most SA Fund Managers continue to feel that our market is expensive, overpriced and over cooked.

Although it does make sense to perhaps lower one’s exposure to local equities, it does not appear to make sense to sell out completely,other than in the very short term if one is expecting a correction.

Source: Stanlib Unit Trusts

Comments